As 2025 approaches, small business owners face increasing challenges to stay profitable while juggling rising costs, unpredictable cash flow, and a shifting market. Whether it’s covering payroll during a slow month or finding funds for unexpected expenses, these common challenges can quickly derail growth plans.

This is where small business cash flow forecasting becomes a critical tool for mitigating risks and reaching your targets. It provides a clear view of your financial future, helping you anticipate and prepare for cash flow highs and lows. The benefits include:

- Making accurate decisions around funding and investments

- Managing economic downturns more effectively

- Avoiding cash shortfalls and maintaining liquidity

- Reducing debt and mitigating financial risks

- Optimizing resource allocation for growth

- Seizing new opportunities when they arise

These are just a few ways a cash flow forecast can keep your business financially healthy and on track for growth and profitability in 2025.

The Importance of Cash Flow Forecasting

Cash flow forecasting helps you see when your cash might dip, giving you the chance to act before it becomes an issue. Instead of scrambling to cover unexpected costs, you can plan ahead, keeping day-to-day operations smooth. This way, you’re not just reacting to problems—you’re timing your investments and growth initiatives for maximum impact.

Considering that 82% of small businesses fail due to poor cash flow management, having a reliable cash flow forecast is essential for long-term success.

But it’s not just about avoiding shortfalls. Cash flow forecasting can also help you spot opportunities to make smarter financial decisions. Whether it’s investing in new equipment or jumping on a timely market opportunity, knowing your future cash position gives you the confidence to make decisions that fuel growth.

Key Benefits of Cash Flow Forecasting

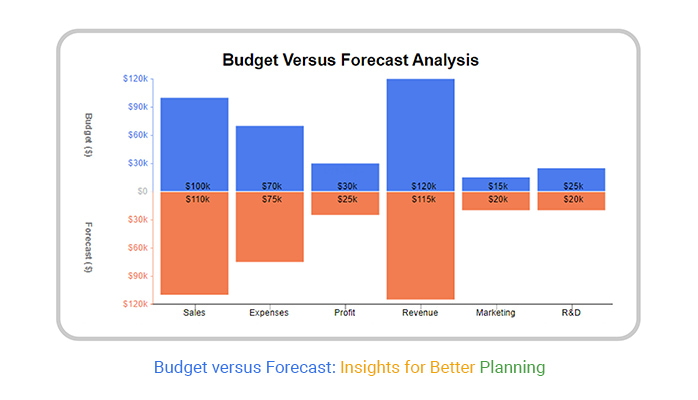

Improved Budget Management

A cash flow forecast gives you a clear picture of your future finances, helping you manage your business budgeting more effectively. By anticipating cash surpluses or shortfalls, you can adjust your budget in real time, ensuring you’re always prepared. This allows you to stay within your financial limits, plan for growth, and allocate resources where they’ll have the most impact.

Integrating cash flow forecasting into your budget management process also lets your business respond to market changes. If your forecast shows a surplus, you can confidently invest in growth areas like R&D or market expansion. Conversely, if a shortfall is expected, you can take early action by cutting non-essential expenses or securing financing to avoid disruption.

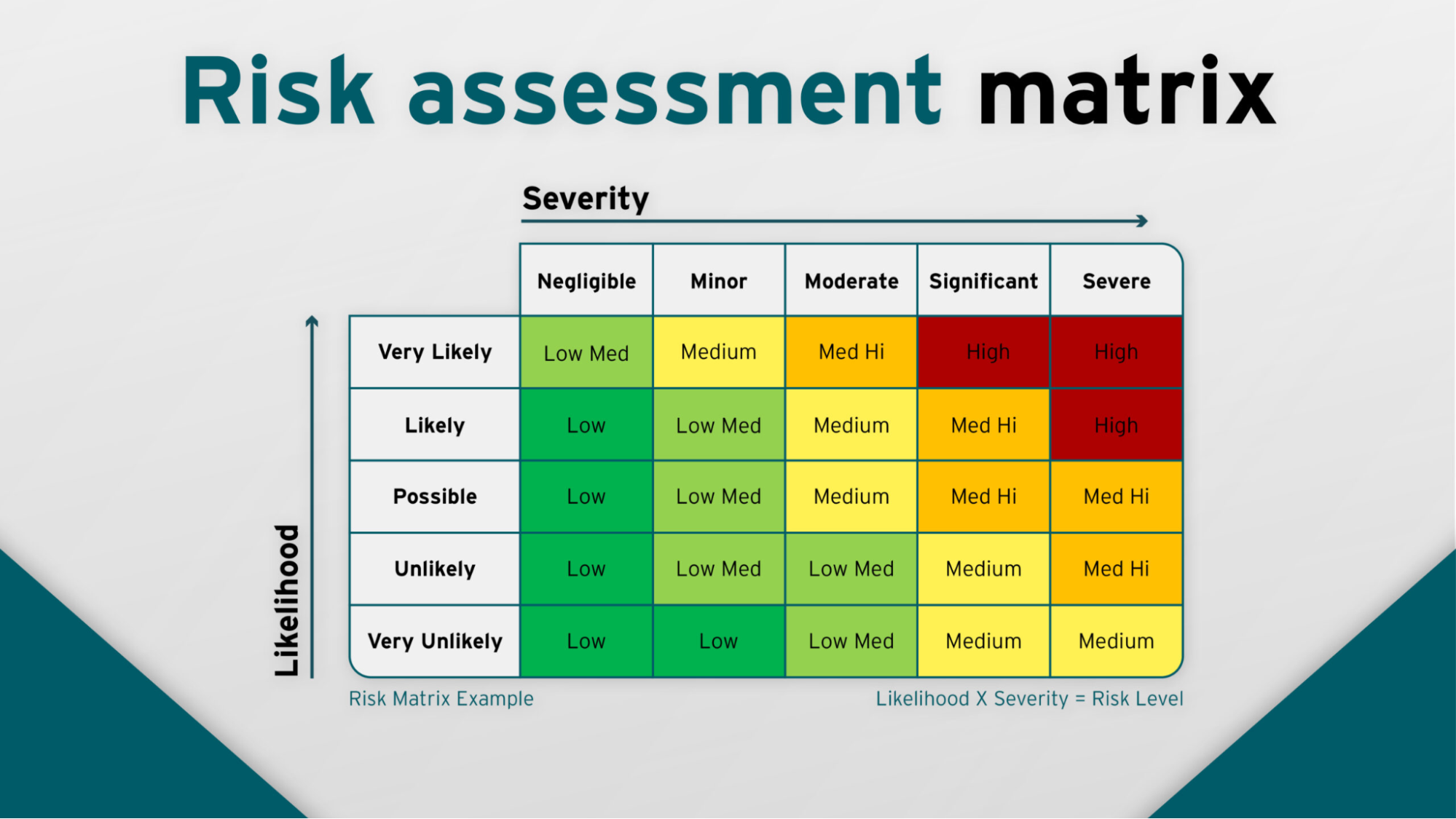

Risk Reduction

Cash flow forecasting helps reduce financial risks by allowing you to foresee potential shortfalls and prepare in advance. By identifying high-risk periods, you can prioritize actions—such as reducing expenses, securing additional funding, or optimizing inventory and receivables management—to maintain liquidity.

These strategies help businesses avoid cash flow interruptions and maintain operational stability, preventing small challenges from escalating into larger financial problems.

Strategic Funding Options

With cash flow forecasting, you can strategically plan large expenditures, ensuring they align with your business’s cash availability.

For companies considering expansion projects or significant purchases, forecasting helps you schedule these investments at the right time, preserving the funds needed for daily operations. This careful timing allows for growth initiatives without jeopardizing cash flow.

Cash flow forecasting helps you identify the best times to invest in growth or new assets. If your forecast shows a cash surplus, you can confidently invest in expansion or make large purchases without needing to take on extra debt.

On the other hand, if a shortfall is expected, you can hold off on non-essential spending, avoiding unnecessary financial strain. By timing these decisions based on your cash flow forecast, you can make smarter investments that support long-term growth while keeping your daily operations running smoothly.

Implementing Cash Flow Forecasting

- Determine your starting point: Gather historical cash flow data to establish a baseline.

- Identify key cash inflows and outflows: Map recurring income and expenses, factoring in seasonal changes.

- Forecast future movements: Use historical data and market trends to project future financial scenarios.

- Update regularly: Continuously refine your forecasts based on performance and market conditions.

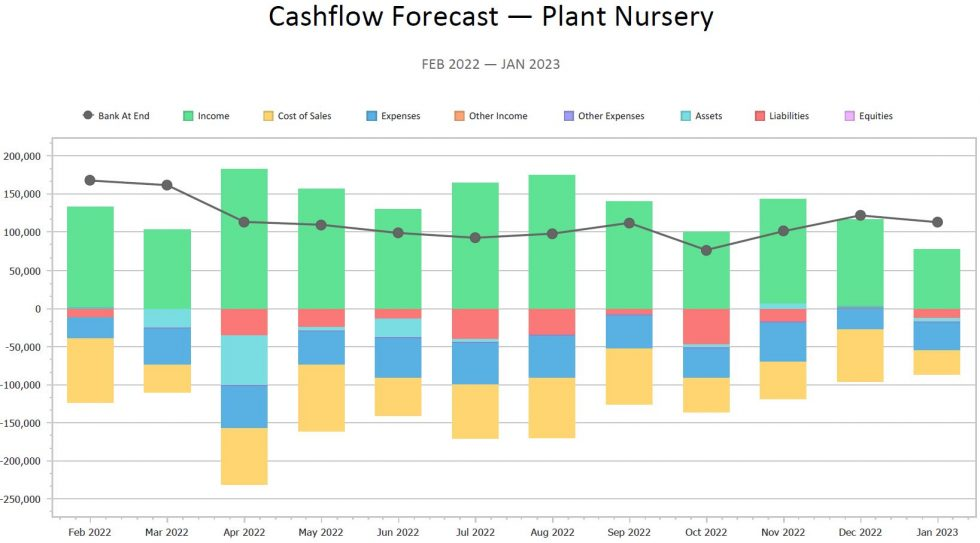

Download our free cash flow forecasting template. Note: The figures are used for template purposes only. Please replace all figures with your own data.

Tools for Effective Cash Flow Forecasting

Having the right tools and technology can make all the difference, as they can enhance the accuracy and usability of your cash flow forecasts. These technologies range from specialized forecasting software to comprehensive enterprise resource planning (ERP) systems integrating various financial functions.

Cloud-Based Platforms

Cloud-based platforms like QuickBooks Online and Xero also support cash flow forecasting by allowing businesses to connect their accounting activities with forecasting functionalities. These platforms offer the advantage of accessibility—financial managers can access and update forecasts from anywhere, ensuring they can react quickly to changes in the business environment.

AI and Machine Learning

Cutting-edge technologies such as artificial intelligence (AI) and machine learning are also being integrated into forecasting tools. These technologies analyze historical data and identify patterns to predict future cash flows with higher accuracy. They can adjust forecasts based on new data inputs, learning to enhance their predictive capabilities over time.

Businesses can use these tools to maintain a responsive approach to cash flow management. By adopting these advanced technologies, companies keep their fingers on the pulse of their financial health and gain the strategic insight needed to drive growth and stability.

Empowering Your Business Through Strategic Forecasting

Embracing cash flow forecasting means monitoring your finances, taking control, and planning a successful future for your business. Whether you’re aiming to boost your cash reserves, support growth initiatives, or streamline your daily financial operations, mastering cash flow forecasting can open up a world of strategic opportunities.

Feeling a bit overwhelmed about where to start? No worries—that’s what we’re here for! At Notion CFO & Advisors, we’re passionate about helping businesses like yours turn forecasting into a superpower. Our team offers personalized guidance and expert insights, tailoring our approach to fit your specific needs.

Why go it alone when you can have an expert team by your side? Reach out to us today. We’re here to help you make smart, informed decisions that fuel your business’s growth and stability.