Maintaining a robust credit score in your business can be a solid indicator of your company’s financial health and could help secure its future.

A strong business credit score can help you get better financing options and more favorable terms from suppliers and enhance your appeal to potential customers and partners.

Understanding Business Credit Scores

A business credit score evaluates a business’s creditworthiness, similar to how personal credit scores function for individuals. Credit bureaus calculate this score based on factors including payment history, credit utilization, length of credit history, public records (such as liens, judgments, and bankruptcies), and demographic information about the business.

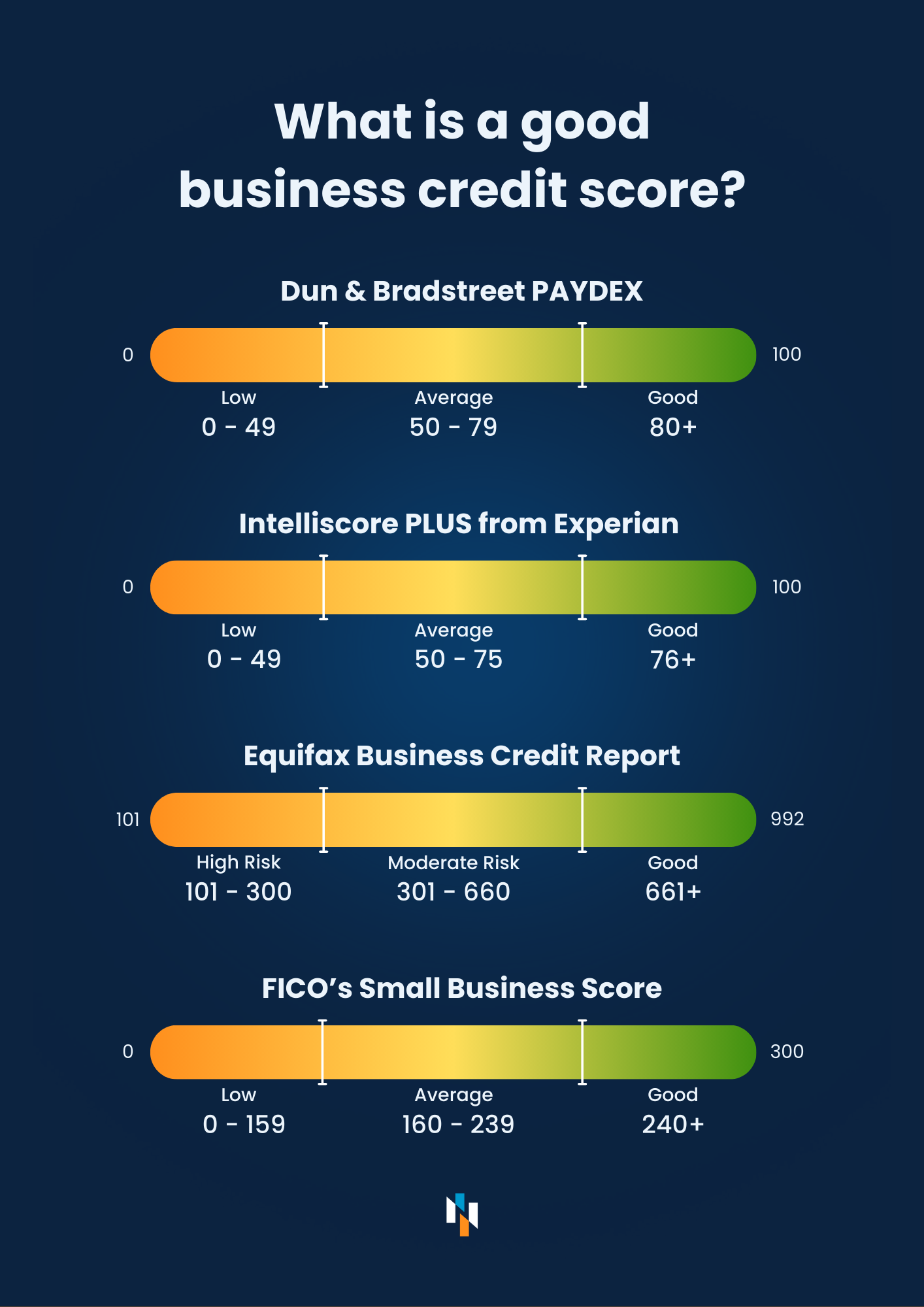

It’s important to note that Business Credit Scores differ from Personal Credit Scores. Business Credit Scores typically range from 0 to 100, where higher scores indicate better creditworthiness. However, each credit bureau may have different score ratings, so review their scoring model to understand your rating.

Why is a Business Credit Score Important?

A robust business credit score is essential for several reasons:

- Financing: It influences your ability to secure loans and credit lines. Lenders assess this score to determine lending risks and to set terms such as interest rates and credit limits.

- Supplier Terms: Suppliers might review your credit score to decide payment terms; a higher score can lead to better payment conditions like longer pay cycles or lower upfront requirements.

- Contract Opportunities: A strong credit score can make your business more attractive in competitive bid situations, especially where contract issuers require specific financial stability.

- Insurance Premiums: Businesses with higher credit scores often enjoy lower insurance premiums as they are deemed lower risk.

Building Your Business Credit Score

Building a strong business credit score doesn’t happen overnight but is achievable with the right approach and consistency.

Establishing Your Business Credit

- Formal Business Registration: Ensure your business is legally registered and that you have an EIN (Employer Identification Number). These are fundamental for being recognized officially and for credit activities.

- Open a Business Bank Account: This should be one of your first steps after registration. It helps keep business finances separate from personal finances, which is crucial for tax purposes and financial management. If you need help choosing a business bank, read our other blog for our top tips.

- Acquire a Business Credit Card: Choose a card from a company that reports to the credit bureaus. Regular usage and timely payments on this card will help build your credit score.

- Set Up Trade Lines with Suppliers: Having multiple credit accounts, such as with suppliers who report to credit bureaus, can boost your credit profile as it shows a history of credit usage and on-time payments.

Strategies to Improve Your Credit Score

- Pay Bills Promptly: The most impactful action is to pay all bills on or before due dates. Timely payments significantly enhance your credit score.

- Manage Credit Utilization: Maintain your credit utilization ratio below 30%. This ratio measures the credit you are using against your available credit limit.

- Monitor Your Credit: Regularly review your credit reports for accuracy. Promptly address discrepancies or unauthorized activities, as these can harm your score.

Navigating Challenges in Credit Building

Building a solid business credit score has its challenges. As you work towards improving your creditworthiness, you may encounter obstacles such as inaccuracies in your credit report, dealing with public records, or the complexities of managing high credit utilization. Overcoming these challenges is crucial to maintaining and enhancing your credit status.

Handling Disputes and Inaccuracies

Occasionally, you may find inaccuracies or outdated information in your credit reports. Handling these disputes promptly is essential. Contact the credit bureau immediately to file a dispute. The bureau usually has 30 days to investigate and remove any inaccuracies, which can help improve your credit score.

Understanding Public Records

Your business’s financial dealings might sometimes lead to public records, such as bankruptcies or liens. These can negatively impact your credit score. It’s crucial to manage finances carefully to avoid such situations, but if they do occur, focus on resolving the issues quickly and rebuilding your credit.

Maintaining a Strong Business Credit Score

Continuous attention and proactive management are required to keep your business credit score strong.

- Regular Credit Monitoring: Check your credit reports frequently to ensure accuracy and to understand how different actions affect your score.

- Update Your Business Information: Keep your business information current with credit bureaus and financial institutions. Changes in your business size, location, or industry can impact your credit score.

- Educate Your Team: Ensure that anyone involved with your business finances understands the importance of good credit practices.

- Plan Financially: Consider how your credit needs might evolve as your business grows, and be prepared to adjust your credit management strategies accordingly.

Taking Strategic Steps Forward

Developing and maintaining a solid business credit score is crucial for operational success and growth. It enhances your financing options, improves supplier relationships, and positions your business favorably in competitive markets. By understanding what affects your credit score and implementing strategic practices to build and maintain it, you ensure your business’s financial health and sustainability.

At Notion CFO & Advisors, we recognize business owners’ challenges when building business credit. Our business lending and financing service is tailored to help you secure affordable lending solutions that align with your financial goals. Whether you are just starting or managing a multi-million dollar enterprise, we focus on transitioning you from high-cost factoring to flexible, lower-cost lines of credit that suit your business’s financial strategy.