Running a SaaS company isn’t just about having a fantastic product and a growing user base. It’s also about finding the right balance between growth and profitability—a balancing act similar to walking a tightrope.

On one side, you are pressured to expand rapidly, capture market share, and stay ahead of competitors. On the other, there’s the need to maintain healthy profit margins, keep operational costs in check, and ensure long-term sustainability.

Many SaaS companies struggle with this balance. Focus too much on growth, and you might find yourself burning through cash with little to show in profit. Prioritize profitability too early, and you could stifle the very growth that sets your company up for future success.

Enter the Rule of 40—a handy metric that simplifies this balancing act. This formula helps you measure whether your company effectively manages its growth and profitability. Combining these elements into a single, easy-to-understand number, the Rule of 40 provides a clear benchmark for your decisions.

What Is the Rule of 40?

The Rule of 40 is a financial guideline used to evaluate the performance of SaaS companies. It combines your company’s growth rate and profit margin to provide a clear benchmark: your growth rate and profit margin combined should equal at least 40%. This metric helps you determine if you’re on the right track to achieving your growth target.

Why the Rule of 40 Matters

Focusing too much on one side of the tightrope can lead to instability. The Rule of 40 helps maintain this balance by offering a clear target:

- Investor Appeal: Investors favor companies that meet the Rule of 40 because it shows you can grow while keeping costs in check. It’s a sign of a well-managed, scalable business.

- Strategic Guidance: This rule acts as a guiding principle, helping you prioritize initiatives and adjust strategies to keep both growth and profitability in focus.

- Operational Efficiency: It encourages you to streamline operations and scale sustainably without sacrificing your bottom line.

Calculating the Rule of 40

Calculating the Rule of 40 is simpler than it sounds. Here’s how you can do it:

First, determine your growth rate by calculating your annual recurring revenue (ARR) growth rate from one year to the next. For example, if your ARR grew from $1 million to $1.3 million over a year, your growth rate is 30%.

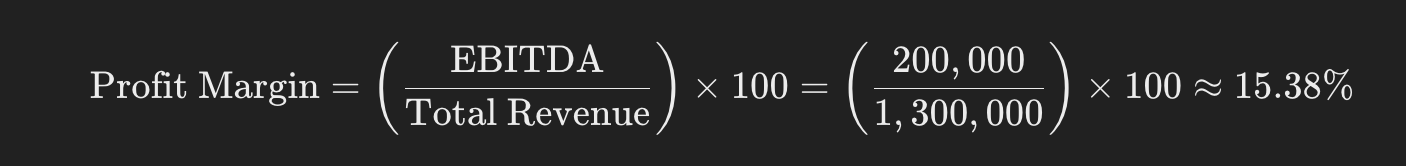

Then, calculate your profit margin: This is typically derived from your earnings before interest, taxes, depreciation, and amortization (EBITDA). If your annual EBITDA is $200,000 and your total revenue for the same period is $1.3 million, your profit margin is about 15.38%.

Here’s the simple math:

Finally, time to add them all up by combining your growth rate (30%) with your profit margin (15.38%) to get 45.38%. Since this exceeds 40%, your company meets the Rule of 40, signaling strong performance.

Making Sense of the Rule of 40 in Real Life

Meeting the Rule of 40 is a strong indicator of a well-managed SaaS business. But what if you’re not quite there yet? It’s a signal to dig deeper and make strategic adjustments.

Say for instance, your growth rate is solid, but your profit margins are lagging. This might suggest rising operational costs or inefficiencies. Or if your profit margins are high but growth is stagnating, it might be time to revisit your growth strategies—whether that means ramping up marketing efforts, expanding into new markets, or enhancing your product offerings.

Tailoring the Rule to Your Business

While the Rule of 40 provides a valuable benchmark, it’s not a one-size-fits-all solution. Depending on your company’s stage and market conditions, you might need to adapt how you apply this rule.

Early-stage companies might prioritize growth over immediate profitability, while more mature businesses might focus on refining their profit margins.

For example, a high-growth startup might operate with a Rule of 40 calculation such as 80% growth and -40% profit margin. This reflects the strategic emphasis on rapid market expansion at the expense of short-term profitability. As the company matures and stabilizes, it can shift focus towards improving operational efficiencies and scaling profitably, gradually working towards a positive profit margin to enhance its Rule of 40 score.

How Notion CFO & Advisors Can Help

At Notion CFO & Advisors, we understand that tracking financial metrics while growing a SaaS business can be challenging. We specialize in helping SaaS companies make sense of financial metrics like the Rule of 40. Our team offers strategic guidance and analytical tools tailored to your unique business needs, allowing you to optimize growth and profitability.

Partnering with Notion means you’re not just aiming to meet industry benchmarks but striving to set new standards. We’ll help you understand the intricacies of your financial health, provide actionable insights, and support you in making informed decisions that drive substantial value.

Ready to unlock your SaaS company’s potential with the Rule of 40? Contact us today to see how we can help your business thrive in a competitive market.